These are the thoughts, events and happenings from the Jazzit Team

April 25 Jazzit Fundamentals update available

- Font size: Larger Smaller

- Hits: 12205

- Subscribe to this entry

- Bookmark

Jazzit has released an update for Jazzit Fundamentals on April 25, 2014. Administrators please click on the link for the log of revisions: http://www.accountants-templates.com/members/content/download/Arialup/Date.pdf

Jazzit has released an update for Jazzit Fundamentals on April 25, 2014. Administrators please click on the link for the log of revisions: http://www.accountants-templates.com/members/content/download/Arialup/Date.pdf

The following updates are included in the April 25, 2014 Jazzit Fundamentals update:

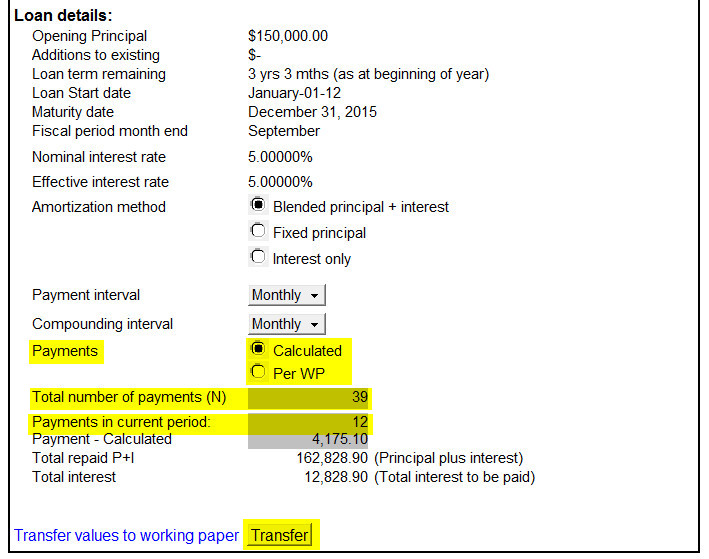

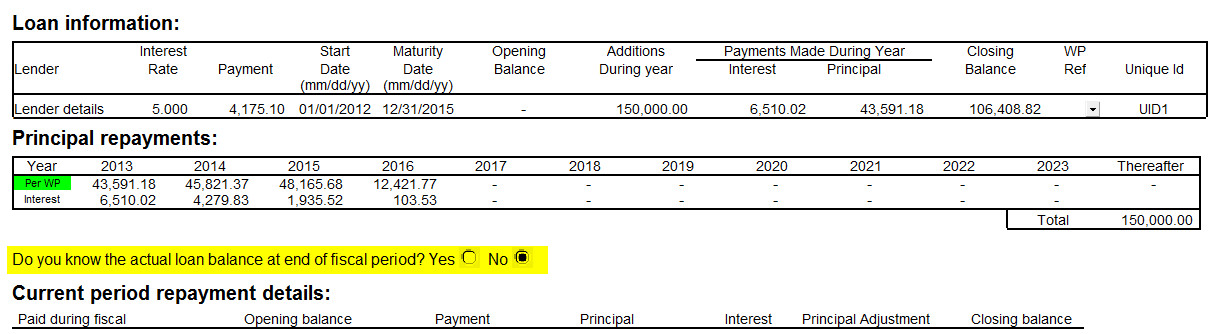

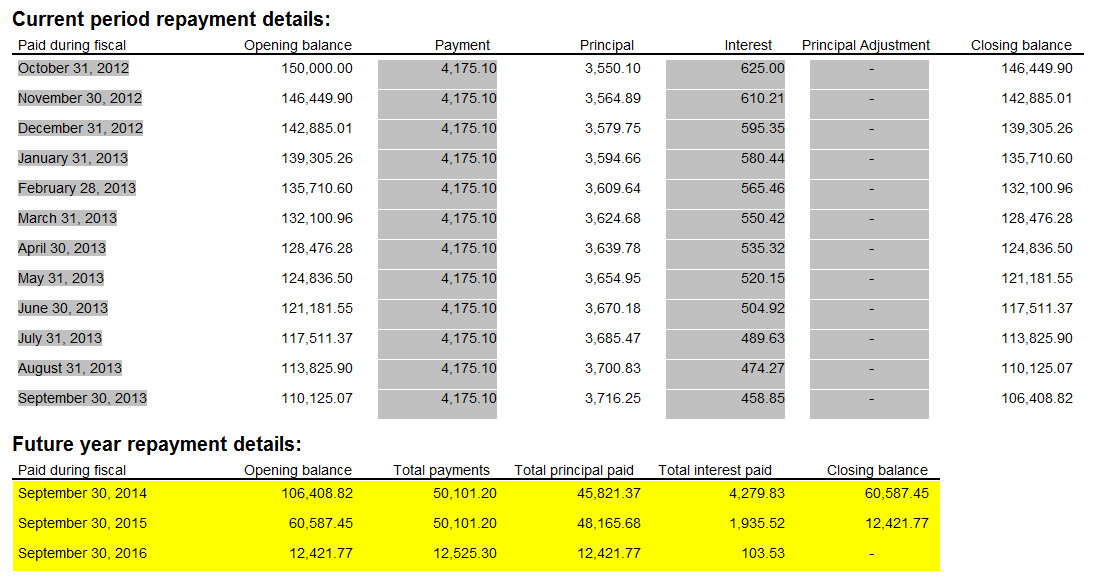

MAJOR UPDATE- Loan & Lease Calculator

- Specify compounding periods and payment intervals (daily, weekly, bi-weekly, semi-monthly, quarterly, semi-annual, annual).

- Added support for interest only and fixed principle loans.

- Accommodates Canadian mortgage calculations.

- Payments can either be calculated, taken from the working paper, or overridden to the desired amount.

- Specify balance outstanding at the end of the current fiscal period if regular payments were made but interest rate was floating.

- Specify total number of payments over the term of the loan if not the same as calculated.

- Specify total number of payments in the current fiscal period if not the same as calculated.

- Separated 'calculate' and 'transfer' buttons so that the working paper will show the amounts calculated before the user has to transfer the amounts to the working paper.

Long Term Debt, Callable Debt, Capital Leases, Loans and Notes Receivable Working Papers

- Added support for the improved Loans & Lease Calculator.

- Improved Diagnostics- When the number of rows are greater in the working paper than the Resource Centre module, a warning appears when updated the working paper indicating which groups will be affected and how many rows will be lost unless added to the Resource Centre.

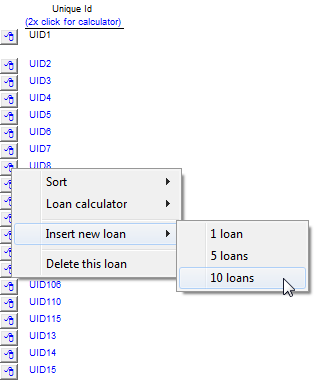

- New option to insert 5 and 10 loans/leases at a time instead of only one.

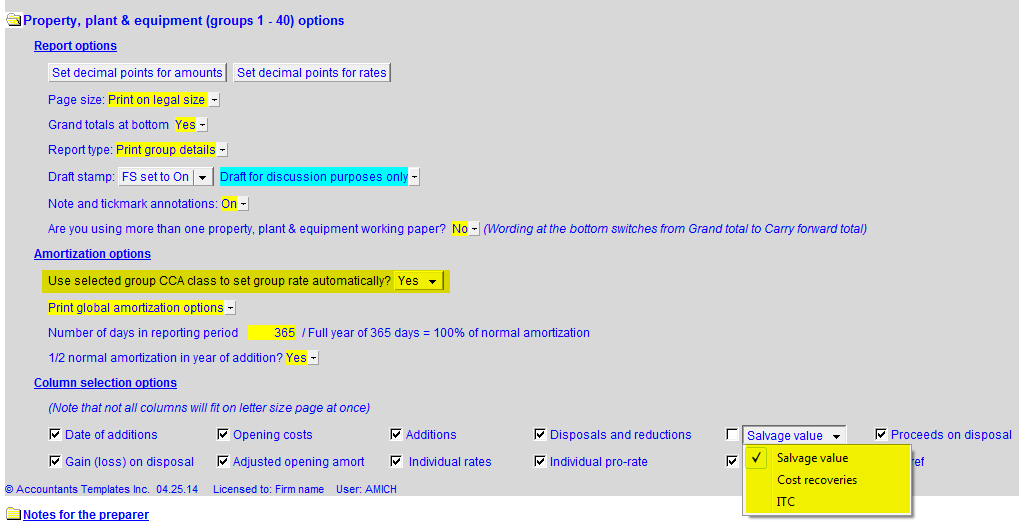

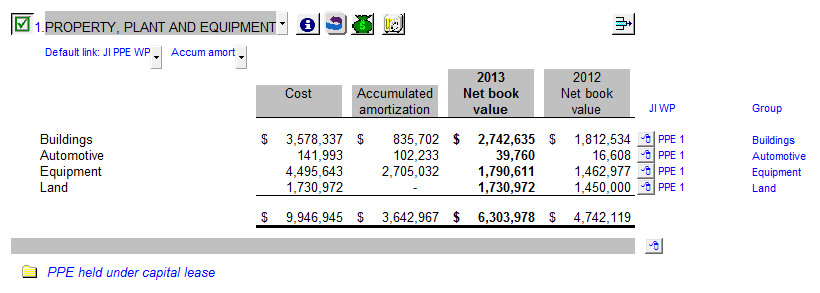

Capital Asset and Intangible Asset Working Papers

- Improved Diagnostics- When the number of rows are greater in the working paper than the Resource Centre module, a warning appears when updated the working paper indicating which groups will be affected and how many rows will be lost unless added to the Resource Centre.

- Added option to select a CCA class for the group and determine whether the selected rate will automatically set the group rate.

- Added option to change heading on cost recoveries column to salvage value or ITC.

- Increased the number of supported groups per working paper from 20 to 40.

- Revised "Show All Groups" popup menu in freeze frame to retain current selection on update of Resource Centre.

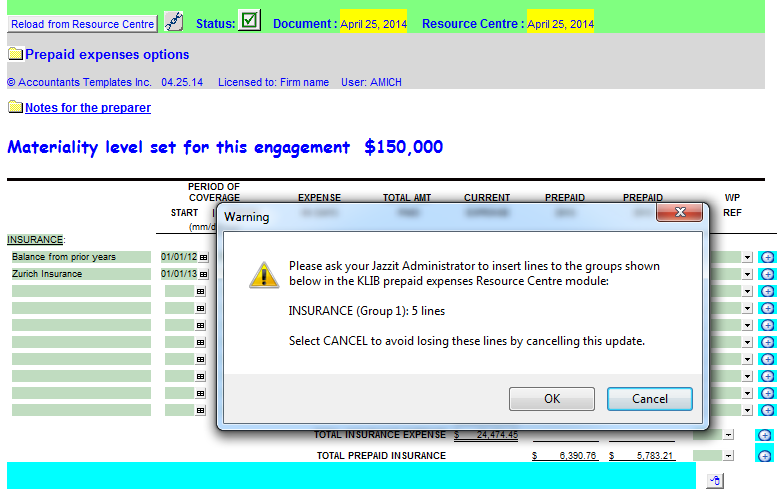

Prepaid Expenses and Deferred Income Working Papers

- Improved diagnostics- When the number of rows is greater in the working paper than the RC module, a warning appears when updating the working paper indicating which groups will be affected and how many rows will be lost unless added to the RC.

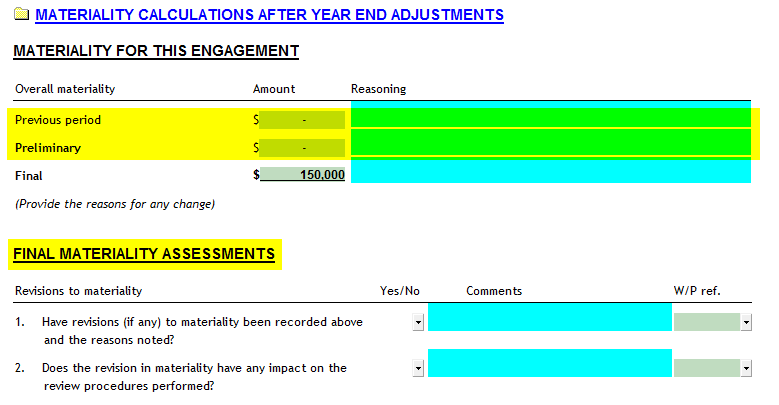

Materiality Guidelines Working Paper

- Revised to reflect information required for a Review Engagement.

- New section added for "Final Materiality Assessments"

- Modified section "Materiality for this engagement" by providing lines for previous period materiality and preliminary materiality along with commentary for each.

- No longer used for an Audit Engagement. Please use JI Checklists package CPEM or PPM for an audit.

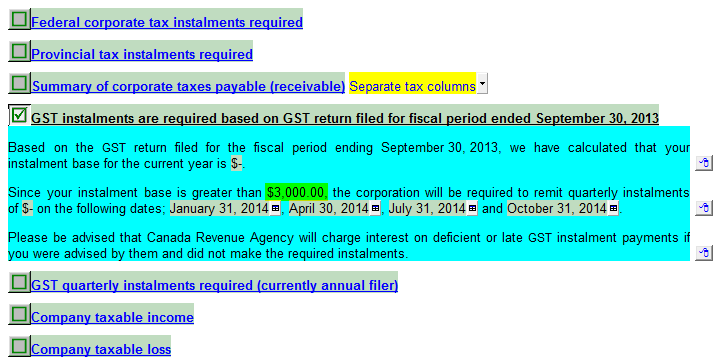

Client Enclosure Letter

- Updated the threshold for GST quarterly installments from $1,500 to $3,000.

GST Simplified Method Working Paper

- Updated the quick method threshold from $200,000 to $400,000.

Marketable Securities Working Papers

- Added support for "Specified Foreign Property" per CRA form T1135 which requires the taxpayer to disclose the maximum cost amount during the year for each security.

Diagnostics Report Working Paper

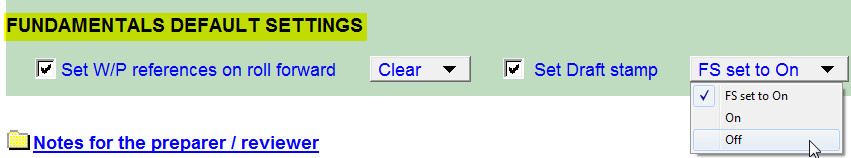

- New section added at the top of the document to set default settings for the working paper references roll forward and draft stamp. This affects all letters and working papers in that engagement.

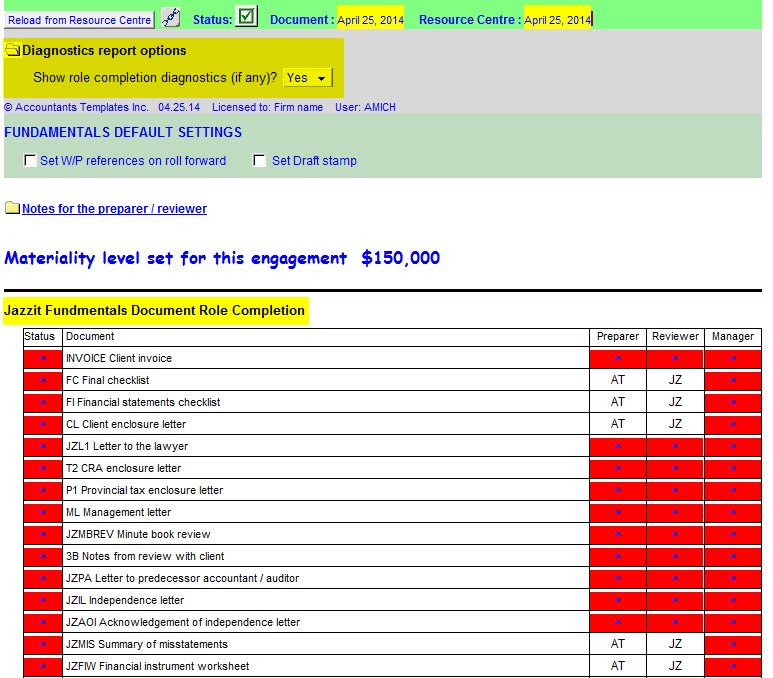

- New section added to the top of the document which shows documents missing role sign-offs.

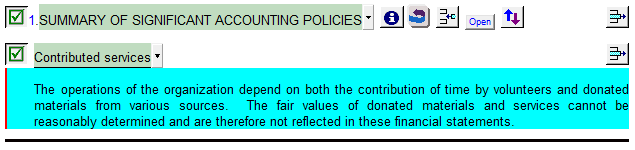

Significant Accounting Policies Note

- Added "Basis of Presentation - introduction to policies" policy.

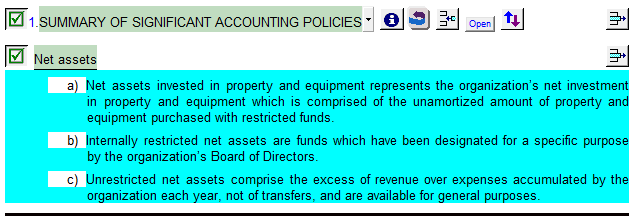

- Added "Net assets" Not for Profit policy.

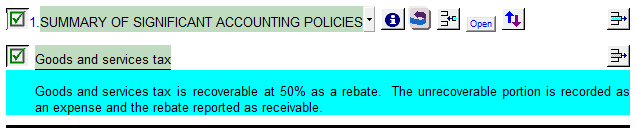

- Added "Goods and Services Tax" Not for Profit policy.

- Updated the "Contributed Services" policy.

- Discontinued differential reporting policy and introduction to policies other than differential reporting.

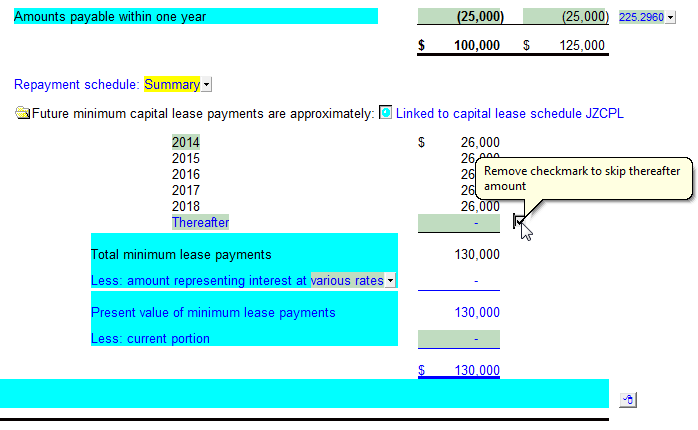

Obligations Under Capital Lease Note

- Modified note linked to Jazzit working paper so when "thereafter" is not selected, interest shown only relates to the next 5 years.

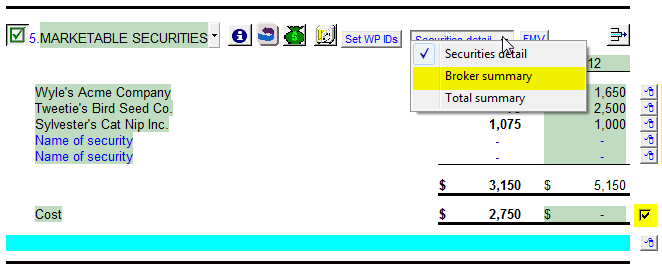

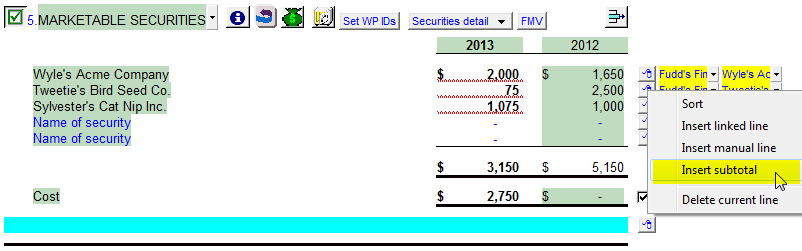

Marketable Securities Note

- Added check box to toggle the optional line show cost at the bottom of the note.

- Added option to show details by brokerage firm.

- Added feature to insert subtotals into either the securities detail or broker summary version of the note linked to working paper.

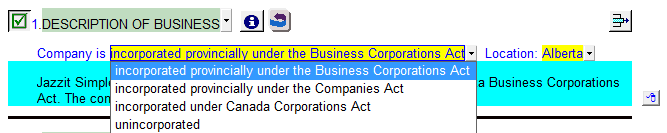

Description of Business Note

- Updated wording to provide more options for different entity types including Not for Profit.

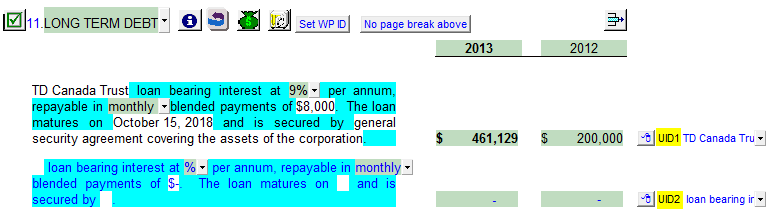

Long Term Debt Note

- Added a loan number to more easily identify the loan to the working paper.

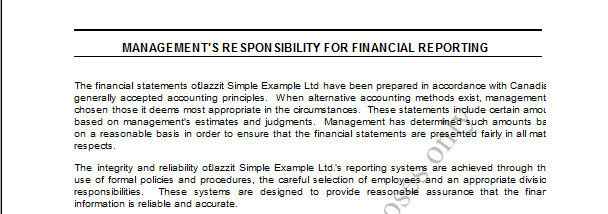

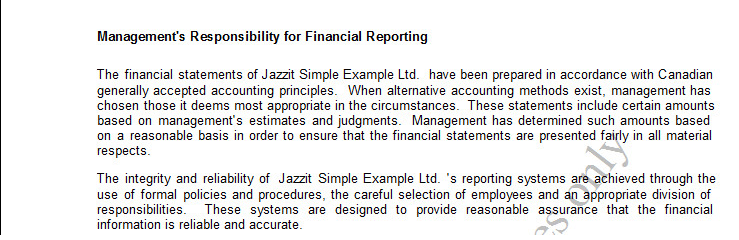

Management's Responsibility Schedule

- Formatted the heading to be consistent with the engagement report. Added additional spacing above and lines around the heading options.

After:

Before:

Capital Asset Note

- Updated to support 40 groups available in the Capital Asset working paper.

Caseware Items

Map Numbers

- Revised the 280 partnership/fund maps, adding partner/funds 6 and 7 and the descriptions.

Document Manager

- Revised names of Property, Plant and Equipment working papers to remove the reference to the number of groups.