These are the thoughts, events and happenings from the Jazzit Team

Featured

July 15 Jazzit Fundamentals update available

- Font size: Larger Smaller

- Hits: 3879

- Subscribe to this entry

- Bookmark

Jazzit has released an update for Jazzit Fundamentals for July 15, 2016

Administrators please click on the link for the log of revisions: Jazzit Fundamentals Update Log

Also check out our new video on 9 column schedule with subtotals

Thanks to everyone who sent in their feedback to us! The following changes are included in the July 15, 2016 Jazzit Fundamentals update:

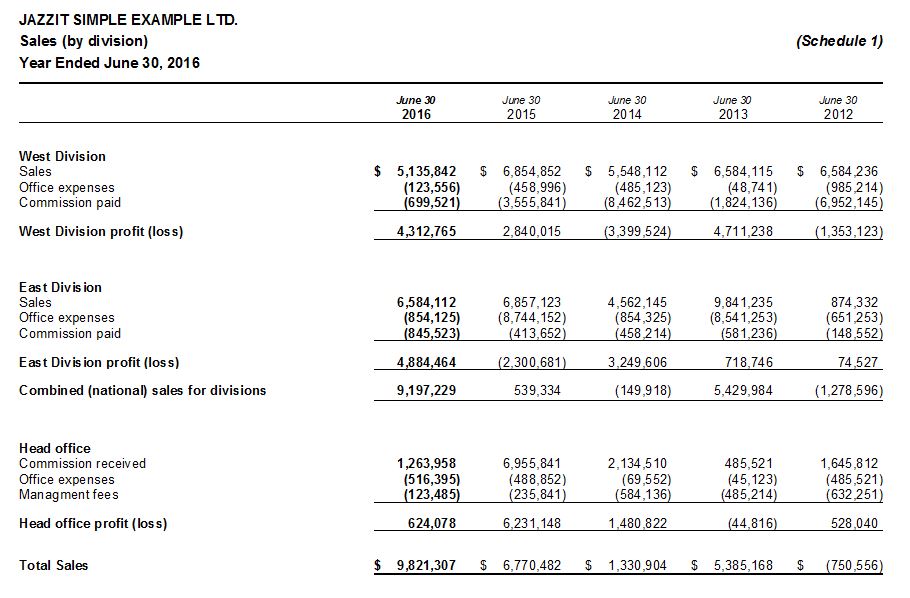

SC2 – Generic 9 column with subtotals

- We have completely overhauled SC2 into a 9 column schedule, complete with six sections, running totals, and total balance transfers to either the Income Statement or Balance Sheet.

You can view the comprehensive guide on this feature here, or watch the video found here

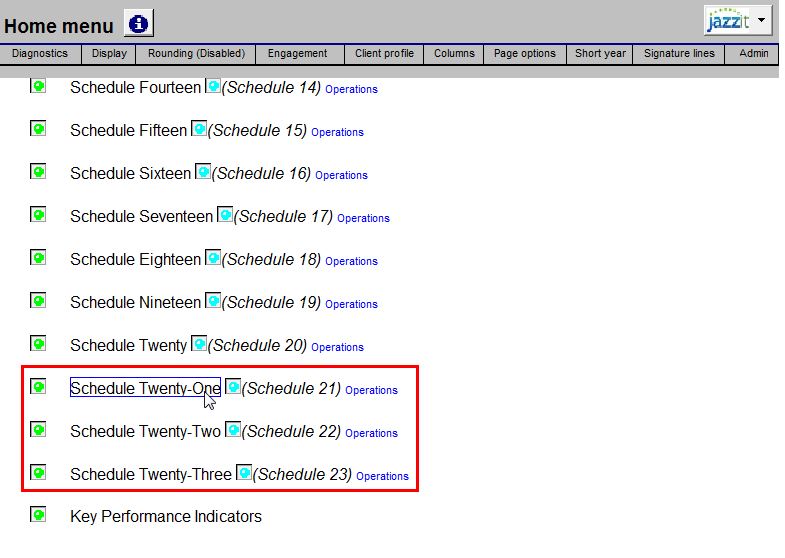

FSSCH21-30 – External schedule 21 to 30

- We have expanded the number of schedules available in the financial statements to 30! These are added as external documents and incorporate directly into your financial statements.

For a detailed guide on how to insert the additional schedules to your Resource Centre and client files, please read the instruction provided here

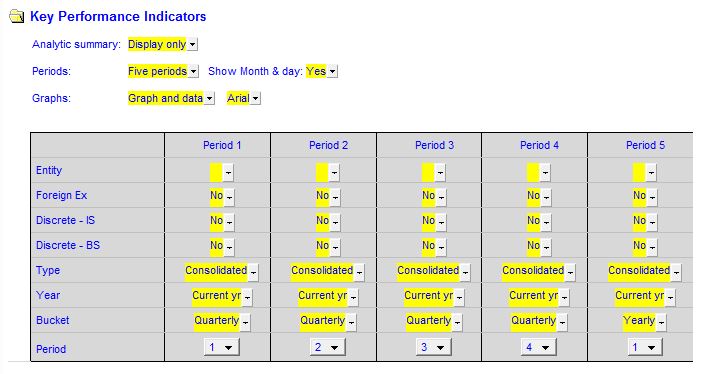

SCRATIOS – Key Performance Indicators

- Added the option to program up to 5 periods for the graphs, charts, and tables

Please note: The month heading can be switched on (off by default) in the schedule settings area. Also when the month heading is on, you can edit this field as desired (e.g. QTR 1... etc)

CP – Home Menu

- Reduced the size and spacing of the diagnostics warnings in the Home Menu to use less screen space when displayed

- Changed the background colors of the diagnostics warnings for better legibility

- Added a “Completing update” message on the Home Menu when updating any module

- Updated certain diagnostics warnings to make them more understandable and relevant to the financial statements

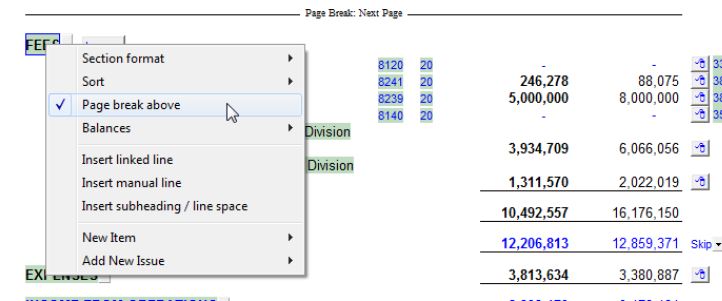

IS/IS2 – Income Statements

- Added the option to include a page break above any section using right-click functionality

IU – Account Analysis

- Added mapping for the Comprehensive income items (292.0001, 292.0002, 292.0003) to the Equity section of the template

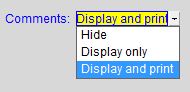

- Added back the comments columns to the right of the columns, with the option to hide, display only or display and print

Please note: There are certain conditions which must be met for this functionality to display correctly. Firstly, there must be ATLEAST ONE amount column selected for the comments to print, and if too many columns are selected (13+) the comments will not be able to print

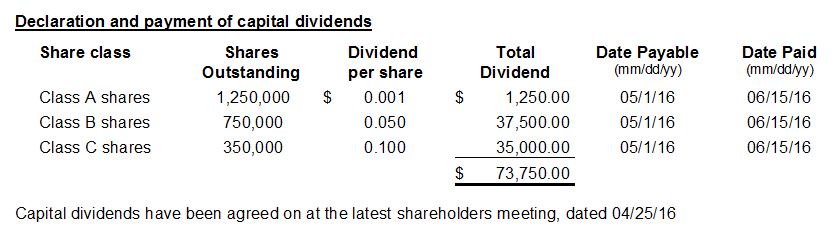

JZl1 – Letter to the lawyer

- Added a section for disclosing of capital dividends declaration and payment

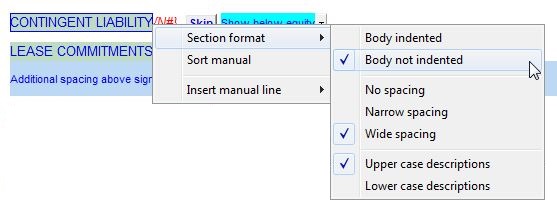

BS/BS2/BS3 – Balance Sheets

- Added formatting options to the contingent liability/lease commitments section of the Balance Sheets together with the option to insert manual lines if needed

EL – Engagement letter

- Audit, Review, Notice to Reader - Updated wording from the latest CPA CPEM July 2016 release

RL – Client’s Representation letter

- Updated wording from the latest CPA CPEM July 2016 release

GS – GST/HST reconciliation (detailed)

- Updated GST/HST rates for NL and NB to 15% effective from July 1, 2016

- Updated GST/HST rates for PEI to 15% effective from October 1, 2016

GS1 – GST/HST reconciliation (simplified)

- Updated GST/HST rates for NL and NB to 15% effective from July 1, 2016

- Updated GST/HST rates for PEI to 15% effective from October 1, 2016

I1 – Client invoice

- Updated GST/HST rates for NL and NB to 15% effective from July 1, 2016

- Updated GST/HST rates for PEI to 15% effective from October 1, 2016