These are the thoughts, events and happenings from the Jazzit Team

November 27 Jazzit Fundamentals Update Available

- Font size: Larger Smaller

- Hits: 5771

- Subscribe to this entry

- Bookmark

Jazzit has released an update for Jazzit Fundamentals on November 27, 2015.

Jazzit has released an update for Jazzit Fundamentals on November 27, 2015.

Administrators please click on the link for the log of revisions: Jazzit Fundamentals Update Log.

Introducing Jazzit Webinars! A fun and easy online way to learn more about your Jazzit package. Check dates and register here!

Also check out our new video on "How to import Excel objects into the Jazzit Templates".

Thanks to everyone who sent in their feedback to us. The following updates are included in the November 27, 2015 Jazzit Fundamentals update:

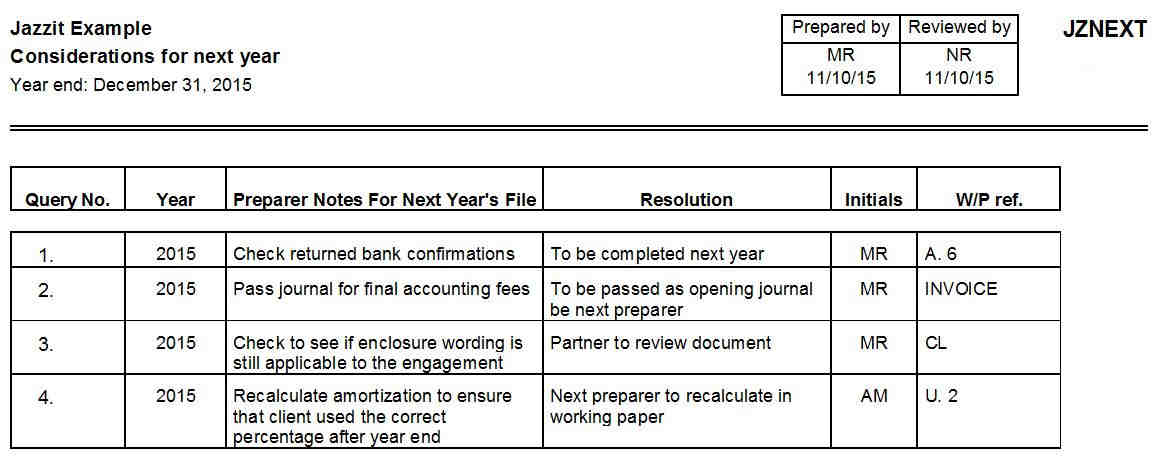

*NEW WORKING PAPER* JZNEXT – Considerations for next year working paper

Introduced a new working paper which allows the preparer to make notes and considerations for the following years file preparer. This working paper does not clear on year end close so it can be completed and cleared in the following year by the next preparer

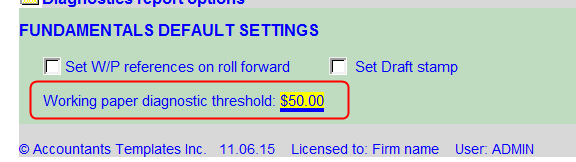

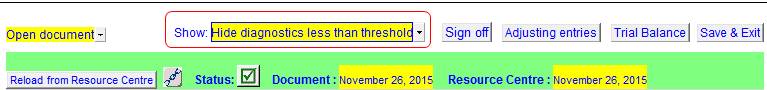

JZDIAG – Diagnostics report

- The diagnostics report now includes the option to specify a different threshold for diagnostics in working papers than the rounding threshold in the financial statement

- Diagnostic report can now either display all the diagnostics in the working paper, or hide diagnostics with values lower than the threshold set above

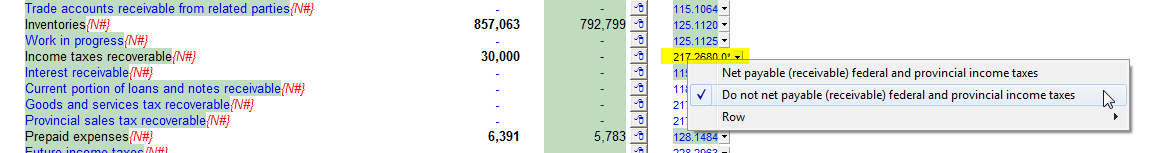

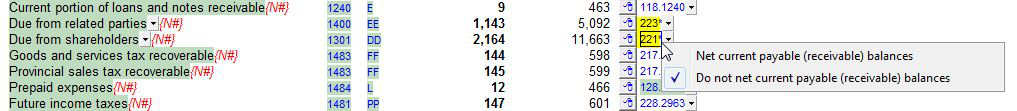

BS, BS2, BS3 – Balance Sheet, 9 column Balance Sheet

- Income tax payable/recoverable can now be shown as either a single amount or split between Asset/Liabilities using a right-click menu option located on the lines mapping number

- Due from/(to) related parties and Due from/(to) shareholders can now be shown as either a single amount or split between Asset/Liabilities using a right-click menu option located on the lines mapping number. This option is only available if there are no related notes for the balances in the financial statements

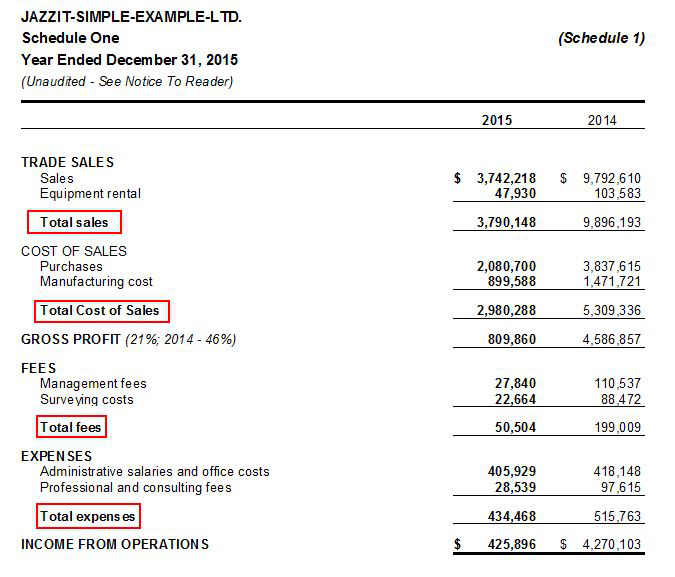

SC1, SC6 – 1-2 year income statement schedule, 1-9 column income statement with budget schedule

- Added the option to display descriptions on section totals similar to those found in the Income Statement, i.e. Total sales, total expenses, etc. These descriptions can also be bolded and indented if required

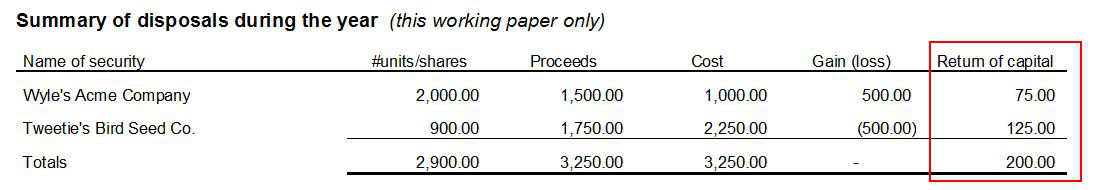

MS – Marketable Securities working papers

- Summary of disposals during the year – Added a “Return of capital” summary column to the table

K5, KG, K9, KV – Debt notes

- Added the optional wording of “which has a carrying value of $...” to each security for additional disclosure

- Added an additional input paragraph under the securities details in each working paper

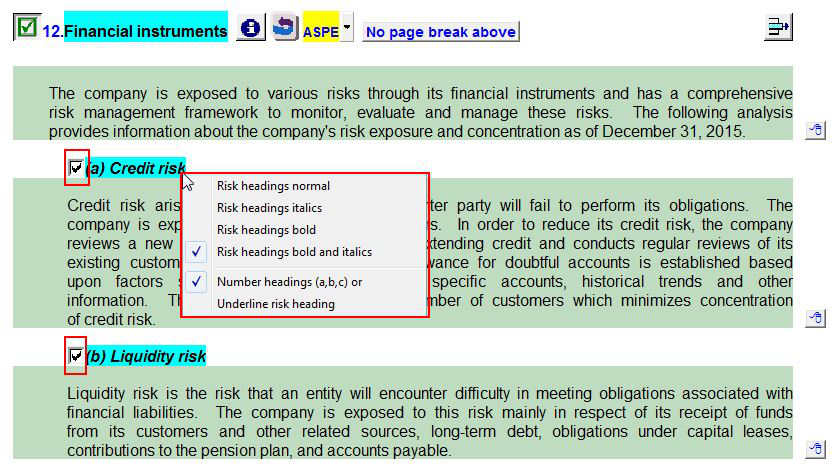

K8 – Financial instruments

- Note has been updated with functionality more consistent with newer notes

KE – Long term investment (Default note)

- Added the ability to insert linked lines

JZIL – Independence letter

- Added the ability to hide the Relationship(s) to disclose and Disclose fees sections if they are not needed

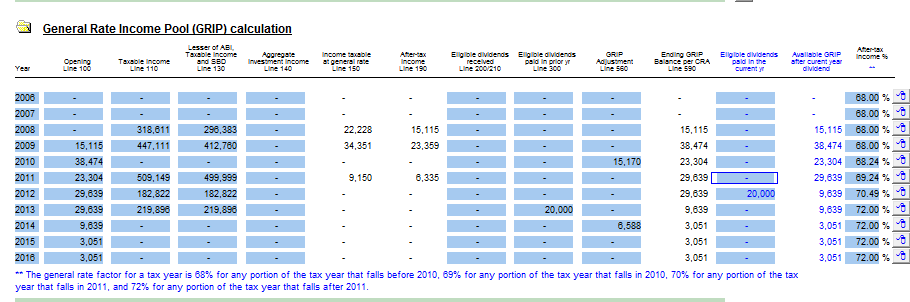

TX – Income taxes

- Any differences in the reconciliation of provision from year to notices of assessment is also populated in the Current year’s income tax expense calculation table

- The General Rate Income Pool (GRIP) table has been updated with new column headings, newer after-tax income percentages, and a column for adjustments